Preface

Looking back at the end of 2023, the rise of the Bitcoin ecosystem can definitely be considered part of the Cryptocurrency chronicles.

From the inscription concept that arose in the first half of the year to the large number of Bitcoin Layer2 that emerged in the second half of the year, it can be said that all flowers bloomed together and all schools of thought contended.

Facing the ever-changing Bitcoin ecosystem projects and related technologies, many friends (including the author) have experienced the process of: can't see - look down on - don't understand - can't keep up.

This series of research reports aims to peel off the superficial concepts of projects and start from the technical essence to give the origins of this wave of prosperity, and then divide the framework for these projects from a technical dimension. It is hoped that through mastering information and establishing frameworks, readers will be able to quickly analyze and judge new projects technically when they encounter them.

Where does the new come from

Readers must be familiar with the topic of Bitcoin scalability, so I won't repeat it here. If interested, you can visit here to fill in the background knowledge.

From the overall ecological development law, asset issuance protocols will first appear, people will use issuance protocols to issue a large number of assets, and then applications (exchange/lending/payment, etc.) will be generated, and a large number of applications will gather together. It will form a prosperous Layer2.

Therefore, assets (protocols/cases)/Layer2 (protocols/applications) will be the core theme for the author's analysis, of which Asset protocols and Layer2 protocols are the focus.

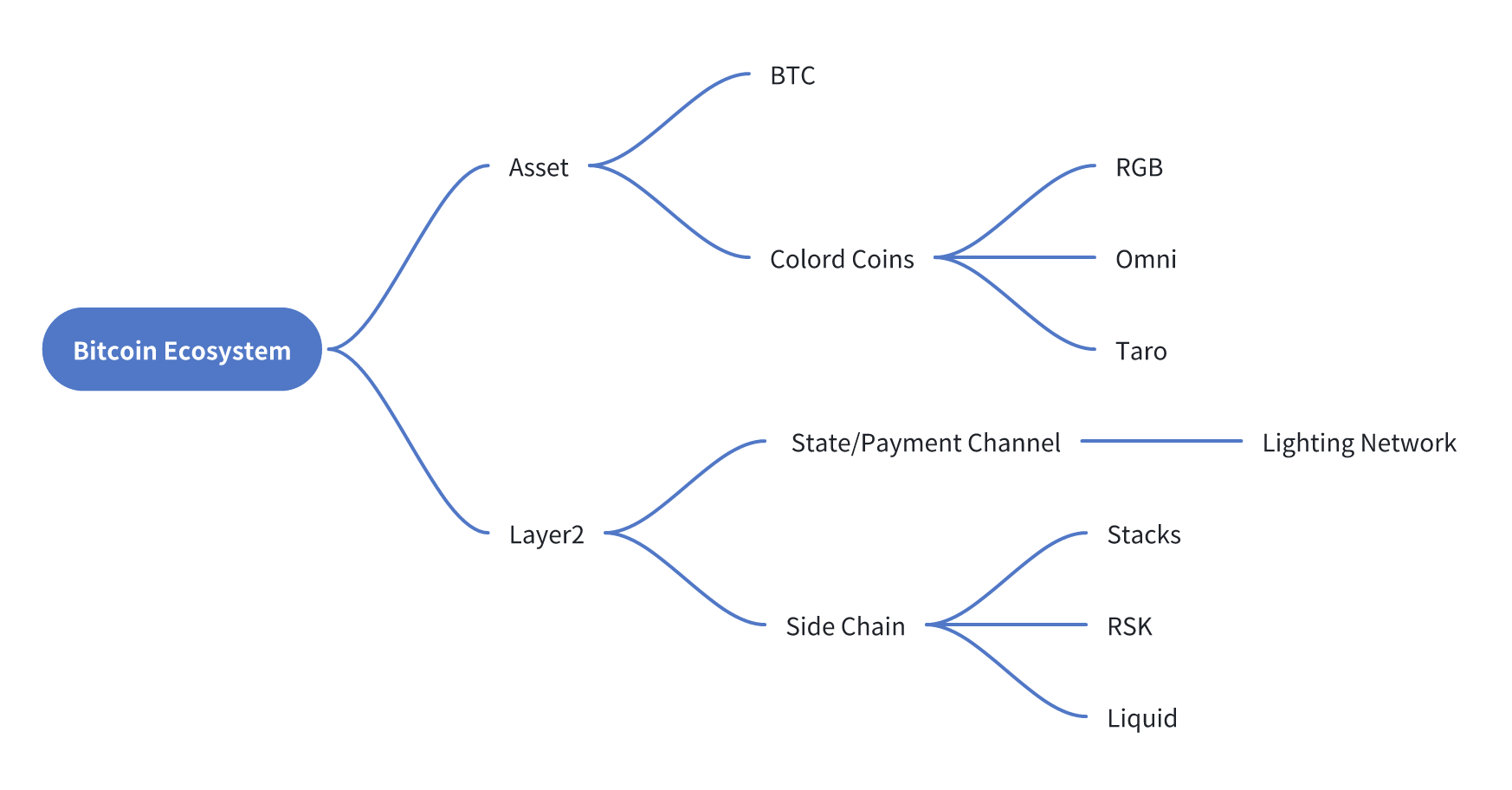

In the many years of Bitcoin ecosystem development, the Bitcoin ecosystem mentioned in various classic books and authoritative analysis articles can be summarized as the following figure:

The development of the Bitcoin ecosystem is changing with each passing day. The above content can no longer cover the latest developments. However, everything has a reason. The author summarizes as follows.

Where is the new momentum

- Internal reasons

Economic motivation:

As a valuable and liquid asset, BTC naturally should have financial attributes, but for various reasons, the ratio of BTC@DeFi is very low, and BTC holders have the appeal to participate in DeFi.

In 2024, Bitcoin will enter the halving cycle, and miners' coinbase income will decrease. Mining groups have the appeal to obtain more income through a more prosperous ecosystem.

Technical motivation:

Bitcoin's last two major upgrades (SegWit and Taproot) combined together make the on-chain processing capabilities and off-chain expression space of the bitcoin chain itself greater, which also promotes the emergence of new assets and new Layer2.

The popularity of client verification and other technical concepts has brought new directions.

- External reasons

The prosperity of the Ethereum ecosystem in the DeFi summer and the practice on Layer2 have objectively affected the development of other public chains.

The concept of modular blockchains (DA, etc.) and the implementation of zero-knowledge proof technology have brought new ideas for Bitcoin expansion.

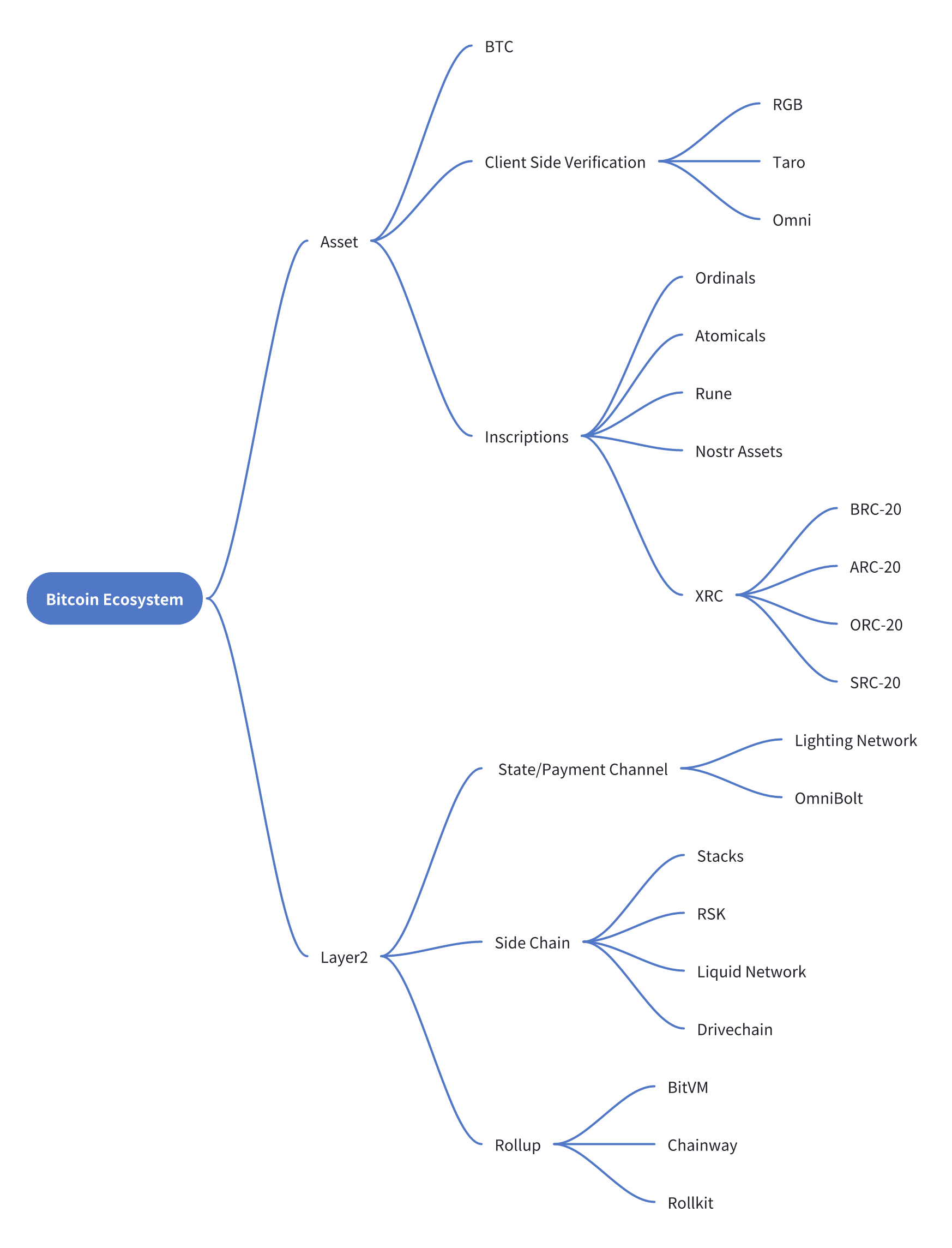

Driven by the above motivations, we can update the above framework content to the latest version.

Classification Overview [DEC. 2023]

In this article, the author will try to make some technical descriptions for each sub-category and protocol within the scope of knowledge. If time permits in the future, I will do technical analysis on specific protocols.

Asset Protocol

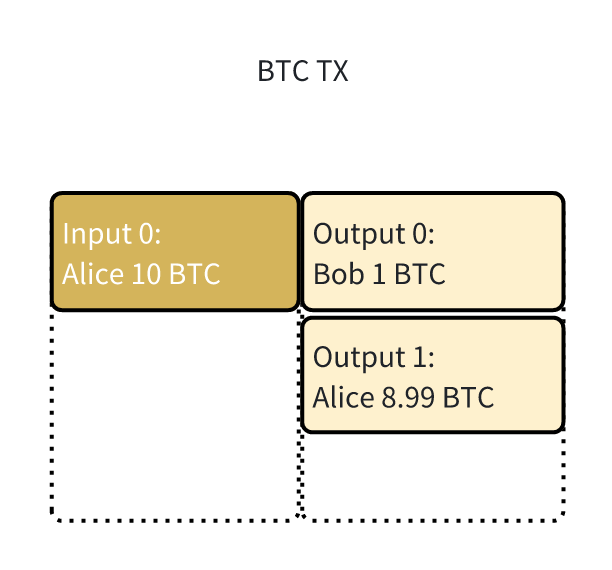

The Bitcoin white paper defines it as a P2P payment system, so it adopts a UTXO model similar to cash payment and change.

In this transaction, Alice wants to pay Bob 1 BTC. Alice constructs a transaction: the input is the 10 BTC UTXO controlled by Alice, and the output is 1 BTC to Bob and 8.99 BTC change, with the remaining 0.01 BTC as the transaction fee.

The UTXOs in the output can carry some additional information, for example, someone once registered wedding information on the bitcoin chain:

1 | OP_RETURN |

With the upgrade of Bitcoin, there are also multiple ways to carry information in UTXO, commonly used are OP_RETURE, SegWit, Taproot, etc.

The code consensus of the Bitcoin network only recognizes one asset called BTC. If you want to issue other assets by leveraging Bitcoin, the ideas people have come up with so far are to add information in the UTXO, and then use an off-chain program to parse the additional information in the UTXO.

An example is to establish a "rare" US dollar collection protocol on top of the US dollar supremacy, described as follows:

Unfold the narrative with US dollar numbers and establish the following Rare-USD protocol:

1 | B__03__54__27__54__F |

It can be seen that some characteristics of the Rare-USD protocol:

- Layer1 (Federal Reserve) is not aware of the existence of this

collectible protocol

- An off-chain consensus needs to be formed (collectors) to ensure its normal operation

The asset protocol Rare-USD protocol described above has no essential difference from the framework, and it is also closely related to the separation of DA (data availability layer) in modular blockchains.

Client-side-verification is a more official term, while inscription is a term coined by the community.

Layer2 Protocol

The existence value of Layer2 depends on the asset protocol and corresponding asset instances.

The three core issues

The author believes that the core of Bitcoin's Layer2 needs to answer three questions:

- Assets

Whether the assets are abundant, whether they can achieve decentralized cross-chain, and whether they have escape capabilities.

- Execution

The state transition of Layer2, whether it has a Turing-complete virtual machine, and whether it is user and developer friendly.

- Validation

How Layer2's execution state can prove innocence, verification costs, etc.

Layer2 Analysis Framework

This article establishes the following analysis framework for Layer2 protocols. For example:

| Project | Technical Route | Asset Security Cross-chain | Asset Escape | Turing Complete | L1 Verify State |

|---|---|---|---|---|---|

| Lighting Network | State Channel | YES | YES | NO | YES |

| Stacks | Side Chain | - | NO | YES | NO |

It is worth noting in particular that the emergence of Rollup types of Layer2 is a highlight. Strictly speaking, Rollup contains validity and sovereign types, the former can achieve on-chain verification.

As a technical solution that can potentially implement validity rollups, BitVM will be expected to truly open a new chapter in Bitcoin's Layer2 ecosystem.

Summary

The article reviews the history of the Bitcoin ecosystem and the driving forces behind innovation and new developments, starting from the two major categories of asset/Layer2 protocols, and attempts to establish an analysis framework for the Bitcoin ecosystem for readers.

Whether it is an asset protocol or a Layer2 protocol, the best way to understand the technical essence is to look at their interaction with Bitcoin's first layer, more specifically, the construction of UTXO inputs and outputs. Subsequent articles will be written to analyze ecosystem protocols from a Bitcoin transaction perspective.

About SigWeb3 Organization

A special interest group focused on Web3, we pay attention to the forefront of Web3 technology and go down to build.

Students with theoretical foundation and engineering capabilities are welcome to join!

Add telegram group: https://t.me/sigweb3

References

https://www.oreilly.com/library/view/mastering-bitcoin-3rd/9781098150082/

https://bitvm.org/bitvm.pdf https://rgb.tech/

https://www.drivechain.info/ https://www.dlc.link/

https://domo-2.gitbook.io/brc-20-experiment/

https://research.web3caff.com/zh/archives/6501